FAQs

Frequently Asked Questions

Find quick answers to your most common questions about our projects, services, and processes.

Reservation and Purchase Process

Once you’ve selected your desired unit or property for reservation, you need to provide the following documents. Your reservation application will be processed only after all reservation requirements have been fully submitted.

RESERVATION REQUIREMENTS:

- Proof of Reservation Fee (RF)

- Signed Reservation Agreement (RA)

- Signed Package Computation of your preferred unit/property – Annex A of RA

- Signed Standard Documentary Requirements Checklist – Annex B of RA

- Signed Buyer’s Information Sheet (BIS)

- Photocopy of 2 valid Government-Issued IDs with signature

- Details of Attorney-In-Fact (AIF) and valid Government-Issued IDs with signature (for OFW/International based buyers)

- Photocopy of Passport (for OFW/International based buyers)

Once all your requirements have been submitted, our Documentation Department will proceed with assessing and evaluating your application. Should additional requirements be requested during the evaluation process, Local buyers will be given three (3) calendar days, while OFW/International buyers will be given seven (7) calendar days to fulfill the additional requirements. Failure to submit pending requirements may lead to disapproval of your reservation application.

Upon approval of your reservation, you will receive a Welcome Letter or call from our Client Management Department.

You are also required to attend a Counseling session within fifteen (15) days from the date of the approved reservation, which will be facilitated by the Documentation Department. During this session, we will explain the company’s policies and guidelines, as well as your responsibilities regarding the unit or property you have acquired.

CANCELLATION OF RESERVATION:

The Reservation Agreement may be canceled for the following reasons.

- Failure to undergo Counseling fifteen (15) days from the date of the approved reservation

- Failure to pay the first Equity/Downpayment (DP)

- Failure to remit any three (3) consecutive monthly installments or amortizations

- Failure to submit complete documentary requirements within thirty (30) calendar days for the locally employed and sixty (60) calendar days for OFW/International from the date of the approved reservation

- Intentional misrepresentation of facts or falsification of any submitted documents

- Voluntary withdrawal from the Reservation Agreement/Contract to Sell for any reason whatsoever

- SPOT CASH PAYMENT TERM

The full Total Contract Price (TCP) is paid in cash 30 days after reservation date - DEFERRED PAYMENT TERM

The Full Total Contract Price is paid throughout the equity period. - STANDARD PAYMENT TERM

The Net Equity is divided equally and is paid throughout the equity period and the remaining balance is paid at the end of the equity term through cash, financing institutions, or in-house loan.

SUBMISSION OF POST-DATED CHECKS:

You are required to prepare the number of Post-Dated Checks (PDCs) covering your down payment:

- If the unit is still under construction, issued PDCs must cover the entire equity period

- If the unit is Ready for Occupancy (RFO), PDCs should cover the required down payment stated in the price list/Final Package Computation

- If you choose to pay the full balance in cash (whether RFO or not), then the PDCs should cover the entire equity period

- If you choose to pay the full balance through financing, PDCs should still cover the entire equity period

- If you choose to pay through an in-house loan, you should cover the entire down payment and the first 5 years of monthly amortization either through post-dated checks (PDCs) or enrollment via BDO ADA Facility.

PAYMENT OPTIONS:

Your down payment and other recurring payments can be paid through the following:

- Postdated Checks (PDCs)

- Auto-debit Arrangement with BDO (ADA)

Note: If you are an OFW/Overseas-based individual, you must designate a family member residing in the Philippines as your ATTORNEY-IN-FACT (AIF). The AIF will be authorized to apply for an ADA facility or issue the necessary post-dated checks for the monthly down payment on your behalf.

Your remaining balance, penalties, fees, and other one-time payments can be paid through the following:

- BDO Bills Payment

- Over-the-Counter Bills Payment for Cash and Check

- Through the BDO Mobile App

- Through BDO Online Banking

- Check

- Cash

Upon approval of your application, we will prepare your Contract to Sell (CTS), Deed of Absolute Sale (DOAS), and Home Improvement Contract (HIC) – if applicable. While your documents are being drafted, we will provide you with a copy of your signed Reservation Agreement.

You will receive a notification via call and/or email once your documents are prepared for signing, and you will be given fifteen (15) calendar days to review, sign, and return the documents to us.

Release of Notarized CTS and HIC:

- Your notarized CTS and HIC will be endorsed to the Turnover Department and will be released upon the unit turnover unless requested earlier.

Release of Notarized DOAS:

- One (1) year from the date of unit turnover along with the transferred title and tax declaration in your name.

Loan Applications

All required documents and payments must be completed within thirty or sixty (30-60) days from the approved reservation date. Failure to do so will result in forfeiture and cancellation of your reservation.

The documents listed below are required for submission:

- Proof of Billing Address (must be the latest billing statement)

- Photocopy of Birth Certificate

- Photocopy of Certificate of No Marriage (if single)

- Photocopy of Marriage Certificate (if married)

- Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

- Photocopy of Death Certificate of Spouse (if widowed)

- Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

- Photocopy of Tax Identification No. (TIN)

- Notarized Special Power of Attorney (SPA) if executed in the Philippines, and a Consularized SPA if executed abroad (if applicable)

- Oath of Allegiance (if buyer is a dual citizen)

BALANCE PAYMENT THROUGH BANK FINANCING:

If undergoing bank financing, you need to complete a Loan Application Form along with the specified requirements. These documents are submitted to our accredited banks for the processing of your bank loan approval, ideally (6) six months before the end of your equity period. Please note that it is at the discretion of the developer to determine which bank your loan application will be submitted to based on your qualifications.

PERSONAL DOCUMENTS: (Must be completed within 30 days from the date of reservation)

- Proof of Billing Address (must be the latest billing statement)

- Photocopy of Birth Certificate

- Photocopy of Certificate of No Marriage (if single)

- Photocopy of Marriage Certificate (if married)

- Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

- Photocopy of Death Certificate of Spouse (if widowed)

- Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

INCOME DOCUMENTS:

IF LOCALLY EMPLOYED (Must be completed within 30 days from the date of reservation)

- Certificate of Employment (CEO) with salary breakdown

- Copy of payslip (at least 6 months)

- Verified Tax Identification Number (TIN) – Principal Buyer and Spouse if Married

- Latest Income Tax Return (ITR) with receipt for the last year

- Photocopy of bank statement (at least 6 months)

IF SELF-EMPLOYED (Must be completed within 30 days from the date of reservation)

- Verified Tax Identification Number (TIN) – Principal Buyer and Spouse if Married

- Latest Income Tax Return (ITR) with receipt for the last 3 years

- Audited Financial Statement for the last 3 years

- Business Permit

- DTI Issued Certificate of Registration

- Copy of lease contract and title of contract (optional)

- Photocopy of bank statement (at least 6 months)

If OVERSEAS FILIPINO WORKERS (Must be completed within 60 days from the date of reservation)

- Certificate of employment/job contract with salary breakdown

- Copy of payslip (at least 6 months)

- Verified Tax Identification Number (TIN) – Principal Buyer and Spouse if Married

- Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

- Photocopy of Passport with Arrival Date

- Photocopy of any (2) valid government-issued IDs with signature and contact number of Attorney In-Fact (AIF)

- Attorney In-Fact (AIF) proof of billing

- Photocopy of bank statement (at least 6 months)

- Proof of remittance (at least 6 months)

IF CORPORATE (Must be completed within 30 days from the date of reservation)

- Audited Financial Statement for the last 3 years

- Verified corporate Tax Identification Number (TIN)

- Latest Income Tax Return (ITR) with receipt for the last 3 years

- Photocopy of BIR Certificate of Registration

- Photocopy of recent BIR Form 1903

- Business permit and license

- Sec Certificate

- Certified True Copy of Secretary Certificate

- Board Resolution

- Valid ID of corporate secretary

- Valid ID of the official representative of the company

- Certified True Copy of Articles of Incorporation

- Photocopy of bank statement (at least 6 months)

IF FOREIGN (Must be completed within 60 days from the date of reservation)

- Certificate of Employment (COE) and compensation

- Copy of payslip (at least 6 months)

- Tax Identification Number (TIN)

- Photocopy of bank statement (at least 6 months)

- Photocopy of any (2) valid government-issued IDs with signature

- Proof of Billing of Attorney In-Fact (AIF)

- Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

- Photocopy of any (2) valid government-issued IDs with signature and contact number of Attorney In-Fact (AIF)

You will be notified through email once your loan application is submitted to our accredited bank/s.

Below is the list of accredited banks:

- BDO

- Security Bank

- BPI

- RCBC

- PNB

- China Bank

- AUB

- Yuanta Savings Bank

- Union Bank

After your application is approved, the bank will provide a Notice of Approval (NOA), confirming that your loan request has been thoroughly reviewed and accepted. It's crucial to verify the loan terms with the bank once you receive your NOA. Following this, the bank will proceed to prepare and issue a Letter of Guarantee (LOG).

The release of your loan normally takes (7) working days from receipt of confirmed/signed LOG, settlement, and submission of the following post-approval requirements:

- Confirmed/Signed Letter of Guarantee (LOG) and Deed of Undertaking (DOU)

- Signed loan documents

- Disclosure Statement

- Real Estate Mortgage

- Loan Agreement with Promissory Note

- Special Power of Attorney (SPA)

Note: Signed & settled to the bank prior to the release of the Bank Guaranty (Bank Process)

- Other requirements

- Post-dated checks

- Mortgage Redemption Insurance (MRI)

Note: Signed & settled to the bank prior to the release of the Bank Guaranty (Bank Process)

- Developer Requirements:

- Full payment of equity/down payment

- Settlement of loan difference (if applicable)

- Signed Contract to Sell (CTS)

Note: Signed & settled to the developer prior to loan release (Developer Process)

All required documents and payments must be completed within thirty or sixty (30-60) days from the approved reservation date. Failure to do so will result in forfeiture and cancellation of your reservation.

The documents listed below are required for submission:

- Proof of Billing Address (must be the latest billing statement)

- Photocopy of Birth Certificate

- Photocopy of Certificate of No Marriage (if single)

- Photocopy of Marriage Certificate (if married)

- Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

- Photocopy of Death Certificate of Spouse (if widowed)

- Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

- Photocopy of Tax Identification No. (TIN)

- Notarized Special Power of Attorney (SPA) if executed in the Philippines, and a Consularized SPA if executed abroad (if applicable)

- Oath of Allegiance (if buyer is a dual citizen)

BALANCE PAYMENT THROUGH PAG-IBIG (HDMF):

You are required to submit a fully accomplished Pag-IBIG Housing Application Form along with the necessary documents listed below. These documents are submitted to Pag-IBIG for the processing of your housing loan approval, preferably (6) six months before the end of your equity period. All documents submitted to Pag-IBIG must be either original or certified true copies.

PERSONAL DOCUMENTS: (Must be completed within 30 days from the date of reservation)

- Proof of Billing Address (must be the latest billing statement)

- Photocopy of Birth Certificate

- Photocopy of Certificate of No Marriage (if single)

- Photocopy of Marriage Certificate (if married)

- Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

- Photocopy of Death Certificate of Spouse (if widowed)

- Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

INCOME DOCUMENTS:

IF LOCALLY EMPLOYED (Must be completed within 30 days from the date of reservation)

- Original notarized Certificate of Employment and Compensation (CEC), indicating the gross monthly income and monthly allowances or monthly monetary benefits received by the employee

- For Government Employees who will be paying their loan amortization through salary deduction, the Certified one (1) month payslip, within the last three (3) months before the date of loan application must be submitted together with CEC or Income Tax Return (ITR)

- Photocopy of Employees Statement of Accumulated Value

- Photocopy of the latest Income Tax Return (ITR) for the year immediately preceding the date of the loan application, with attached BIR Form No. 2316, stamped and received by the BIR

- Original copy of Certified one (1) month payslip, within the last three (3) months before the date of loan application

IF SELF-EMPLOYED (Must be completed within 30 days from the date of reservation)

- Photocopy of latest Income Tax Return

- Photocopy of latest Audited Financial Statements

- Photocopy of DTI Issued Certificate of Registration

- Photocopy of Business Permit & License

- Commission Vouchers Reflecting the Issuer’s Name and Contact Details (for the Last 12 months)

- Photocopy of bank Statements or Passbook for the last 12 months (in case income is sourced from foreign remittances, pensions, etc.)

- Photocopy of Lease Contract and Tax Declaration (if income is derived from rental payments)

- Certified True Copy of Transport Franchise issued by an appropriate government agency (LGU for tricycles, LTFRB for other PUVs)

- Certificate of Engagement issued by the Owner of a Business

IF OVERSEAS FILIPINO WORKERS (Must be completed within 60 days from the date of reservation)

- Photocopy of Employment Contract

- Photocopy of Employment Contract between employee and employer; or

- Photocopy of POEA Standard Contract

- Photocopy of Employees Statement of Accumulated Value

- Photocopy of Certificate of Employment and Compensation (CEC)

- Original copy of CEC written on the Employer/Company’s official letterhead; or

- CEC signed by the employer (for household staff and similarly situated employees) supported by a photocopy of the employer’s ID or passport

- Original copy of Special Power of Attorney (SPA) notarized by a Philippine Consular Officer, or SPA notarized by a local notary (of the country where the member is working) but duly authenticated by the Philippine Consulate

- The Pag-IBIG may also require any or a combination of the following documents: (Photocopy Only)

- Payslip indicating income received and period covered

- Valid OWWA Membership Certificate

- Overseas Employment Certificate

- Passport with appropriate visa (working visa)

- Residence card/permit (permit to stay indicating work as the purpose)

- Bank remittance record

- Professional License issued by Host Country/Government

Here is the list of Pag-IBIG documents that you must also sign before your housing loan application is endorsed.

- Authorization to conduct CIBI (Credit/Background Investigation)

- Pag-IBIG Housing Loan Application Form

- Membership Status Verification Slip (MSVS)

- Loan Mortgage Agreement (signed by the buyer and the developer’s representative)

- Promissory Note (signed by the buyer and the developer’s representative; should be notarized)

- Certificate of Acceptance (signed by the buyer and the developer’s representative; should be notarized)

- Approved Preliminary Appraisal

- Certificate of House and Lot Acceptance (signed by the buyer and the developer’s representative; should be notarized)

- Deed of Assignment (signed by the buyer and the developer’s representative; should be notarized)

- Deed of Absolute Sale (signed by the buyer and the developer’s representative; should be notarized)

- Contract to Sell (signed by the buyer and the developer’s representative; should be notarized)

- Developer’s Sworn Certification (signed by the buyer and the developer’s representative; should be notarized)

- Lot Plotting

You will be notified through email once your housing loan application is submitted to Pag-IBIG.

For approved loan applications, Pag-IBIG shall issue a Notice of Approval (NOA). This document serves as a confirmation of the housing loan’s approval.

Upon issuance of the NOA, you must confirm and sign the document. If you are an Overseas Filipino Worker (OFW), the designated Attorney-In-Fact (AIF) is authorized to sign the NOA on your behalf. In case you fail to sign the NOA after one (1) month from the date of approval, Pag-IBIG will consider the loan application withdrawn.

Note: If the application is withdrawn, the developer will have the option to re-apply with a re-filing Fee of Php 1,000 which will be shouldered by the buyer.

The release of your loan normally takes seven (7) working days from receipt of the following post-approval requirements including house inspection. These documents shall be submitted to Pag-IBIG along with the title before the release of loan proceeds.

- Signed Loan Documents

- Loan Mortgage Agreement

- Promissory Note

- Deed of Absolute Sale (DOAS)

- Certificate of Acceptance

- Tax Declaration

- Tax Clearance

- Real Property Tax Receipt

- Annotated Deed of Assignment (DOA)

- Special Power of Attorney (SPA)

- Lot Plan

- Developer Requirements:

- Full payment of equity/down payment

- Settlement of loan difference (if applicable)

- Signed Contract to Sell (CTS)

Note: Signed & settled to the developer prior to loan release (Developer Process)

All required documents and payments must be completed within thirty or sixty (30-60) days from the approved reservation date. Failure to do so will result in forfeiture and cancellation of your reservation.

The documents listed below are required for submission:

- Proof of Billing Address (must be the latest billing statement)

- Photocopy of Birth Certificate

- Photocopy of Certificate of No Marriage (if single)

- Photocopy of Marriage Certificate (if married)

- Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

- Photocopy of Death Certificate of Spouse (if widowed)

- Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

- Photocopy of Tax Identification No. (TIN)

- Notarized Special Power of Attorney (SPA) if executed in the Philippines, and a Consularized SPA if executed abroad (if applicable)

- Oath of Allegiance (if buyer is a dual citizen)

BALANCE PAYMENT THROUGH IN-HOUSE LOAN:

When applying for an in-house loan, you will undergo an assessment to determine your eligibility. Upon approval of your in-house loan application, you will be required to submit the following documents and requirements:

- Auto-Debit Arrangement (ADA) Application Form

- The down payment and the remaining balance under the in-house loan shall be paid through ADA.

- Insurance

- Mortgage Redemption Insurance (MRI) and Fire Insurance. This insurance provides coverage in case of the death of the buyer, as well as loss or damage of property caused by fire.

- Complete Personal and Income Documents

- PERSONAL DOCUMENTS: (Must be completed within 30 days from the date of reservation)

- Proof of Billing Address (must be the latest billing statement)

- Photocopy of Birth Certificate

- Photocopy of Certificate of No Marriage (if single)

- Photocopy of Marriage Certificate (if married)

- Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

- Photocopy of Death Certificate of Spouse (if widowed)

- Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

- INCOME DOCUMENT:

IF LOCALLY EMPLOYED (Must be completed within 30 days from the date of reservation)

- Certificate of Employment (CEO) with salary breakdown

- Copy of payslip (at least 6 months)

- Verified Tax Identification Number (TIN) – Principal Buyer and Spouse if Married

- Latest Income Tax Return (ITR) with receipt for the last year

- Photocopy of bank statement (at least 6 months)

IF SELF-EMPLOYED (Must be completed within 30 days from the date of reservation)

- Verified Tax Identification Number (TIN) – Principal Buyer and Spouse if Married

- Latest Income Tax Return (ITR) with receipt for the last 3 years

- Audited Financial Statement for the last 3 years

- Business Permit

- DTI Issued Certificate of Registration

- Copy of lease contract and title of contract (optional)

- Photocopy of bank statement (at least 6 months)

- Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

If OVERSEAS FILIPINO WORKERS (Must be completed within 60 days from the date of reservation)

- Certificate of employment/job contract with salary breakdown

- Copy of payslip (at least 6 months)

- Verified Tax Identification Number (TIN) – Principal Buyer and Spouse if Married

- Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

- Photocopy of Passport with Arrival Date

- Photocopy of any (2) valid government-issued IDs with signature and contact number of Attorney In-Fact (AIF)

- Attorney In-Fact (AIF) proof of billing

- Photocopy of bank statement (at least 6 months)

- Proof of remittance (at least 6 months)

IF CORPORATE (Must be completed within 30 days from the date of reservation)

- Audited Financial Statement for the last 3 years

- Verified corporate Tax Identification Number (TIN)

- Latest Income Tax Return (ITR) with receipt for the last 3 years

- Photocopy of BIR Certificate of Registration

- Photocopy of recent BIR Form 1903

- Business permit and license

- Sec Certificate

- Certified True Copy of Secretary Certificate

- Board Resolution

- Valid ID of corporate secretary

- Valin ID of the official representative of the company

- Certified True Copy of Articles of Incorporation

- Photocopy of bank statement (at least 6 months)

IF FOREIGN (Must be completed within 60 days from the date of reservation)

- Certificate of Employment (COE) and compensation

- Copy of payslip (at least 6 months)

- Tax Identification Number (TIN)

- Photocopy of bank statement (at least 6 months)

- Photocopy of any (2) valid government-issued IDs with signature

- Proof of Billing of Attorney In-Fact (AIF)

- Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

- Photocopy of any (2) valid government-issued IDs with signature and contact number of Attorney In-Fact (AIF)

You have the option to secure an in-house loan covering up to eighty percent (80%) of the total contract price which can be payable for up to ten (10) years following the prescribed interest rates.

The in-house loan payment terms and rates are listed below:

| PAYMENT TERMS | IN-HOUSE RATE |

| 10 years | 20% |

| 5 years | 18% |

| 3 years | 16% |

| 1 year | 12% |

Note: Any payment structure that does not fall within the implementing guidelines will be subject to special approval from the management.

While preparing the Contract to Sell and other legal paperwork, we will also generate the In-House Loan Agreement. This agreement contains the payment terms, interest rates, and the repayment schedule of the loan. The In-House Loan Agreement should be signed before the first loan amortization payment schedule.

Payments and Financial Matters

The Statement of Account (SOA) is sent to your registered email address on a quarterly basis. Should you wish to get an advance or hard copy of your SOA, a request letter/email must be submitted to our Client Management Department.

Only the Principal Buyer or their Authorized Representative is permitted to request and receive the SOA.

The following must be presented when receiving the SOA:

- Principal Buyer

- Valid ID

- Authorized Representative

- Valid ID of the authorized representative

- Authorization Letter signed by the Principal Buyer

- Photocopy of the Principal Buyer’s valid ID

The Official Receipts (ORs) shall be available for pick up at the Head Office cashier seven (7) working days after the due date/deposit date.

Only the Principal Buyer or their Authorized Representative is permitted to request and receive the OR.

The following must be presented when receiving the OR:

- Principal Buyer

- Valid ID

- Authorized Representative

- Valid ID of the authorized representative

- Authorization Letter signed by the Principal Buyer

- Photocopy of the Principal Buyer’s valid ID

To request for PDC holding and pull-out, a request letter/email must be submitted to our Client Management Department at least seven (7) working days before the due date, indicating the reason and the new re-deposit date. All PDC holdings and pull-outs will be endorsed to our Credit and Collection Department for verification.

You may only request for holding and pull-out of PDCs twice (2x) within the entire duration of the equity period. An Administrative Fee of Php 100.00 per check will be charged for each check pullout or holding, in addition to any penalties incurred due to delayed payment.

Only the Principal Buyer or his/her Authorized Representative (with Authorization Letter) is allowed to request for holding of deposits/payment.

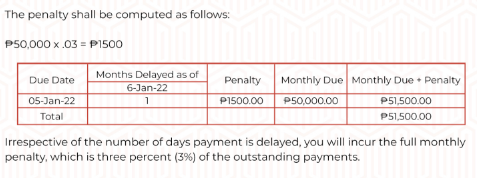

A penalty equivalent to three percent (3%) of outstanding payments shall be charged in full if payment is not received on or before the scheduled monthly due date.

Example:

Monthly Equity: ₱50,000.00

Due Date: Every 5th of the month

If you did not pay on the due date, the penalty shall be applied to the equity amount one day after the due date.

The penalty shall be computed as follows:

₱50,000 x .03 = ₱1500

| Due Date | Months Delayed as of | Penalty | Monthly Due | Monthly Due + Penalty |

| 6-Jan-22 | ||||

| 05-Jan-22 | 1 | ₱1500.00 | ₱50,000.00 | ₱51,500.00 |

| Total | ₱51,500.00 | |||

Irrespective of the number of days payment is delayed, you will incur the full monthly penalty, which is three percent (3%) of the outstanding payments.

Requests to change the mode of balance payment (e.g., from bank financing to cash, Pag-IBIG financing, or in-house loan) must be made at least eight (8) months before the end of the equity period. Additionally, you will undergo a pre-assessment to determine eligibility. Upon qualifying in the pre-assessment, the developer will approve your request for the change in the balance payment term.

If a request to change the mode of balance payment is made after the deadline, a penalty of Fifty Thousand Pesos (Php 50,000.00) will be charged to the buyer. This penalty applies to all types of balance payment conversions except for bank financing to cash.

Note: The developer shall reserve the right to change the penalty amount at any time without further notice.

Ownership and Account Management

Transfer of units within the project is subject to approval. The following are the requirements and procedures to process your request to transfer from one unit to another.

- Original/signed Request Letter addressed to Client Management Department

- Updated Buyer’s Information Sheet (BIS)

To be eligible for a unit/house transfer, the following circumstances will be taken into consideration:

- You must have a good payment history (no existing penalties/unpaid balance with the current unit)

- The current unit has not been turned over. Therefore, Read for Occupancy (RFO) units are not allowed for transfer

- The Deed of Sale has not been notarized

- The preferred new unit is under the same project

- In the case of transfer to a lower-priced unit, the new unit must have the same or shorter equity term relative to the original unit

FOR HOUSE AND LOT:

- The transfer will not be allowed if the construction of the current house has started

- The transfer will only be allowed if the equity term difference between the original and the new unit is six (6) months or less

- The request must be made at least six at least (6) months before the end of equity if the outstanding balance on Total Contract Price (TCP) shall be paid through Bank Financing

FOR CONDOMINIUM UNITS:

- The request must be made at least six (6) months before the project’s turnover date

A transfer fee of Fifty Thousand Pesos (Php50,000.00) will be deducted from the total equity payments made if the request is approved. If the request is made within seven (7) calendar days after the date of reservation, no transfer fee is required. Please note that you are only authorized to transfer units once (1x) for individual sales and twice (2x) for bulk sales.

If the value of the previously issued Post-Dated Checks (PDCs) is lower than the required payment upon transfer of the unit, you must issue a new set of Post-Dated Checks.

Upon the approval of the transfer of the unit, all legal documents associated with the transfer of the unit shall be prepared. Below are the legal documents for preparation:

- Contract to Sell (CTS)

- Deed of Absolute Sales (DOAS)

- Home Improvement Contract (HIC) – if applicable

You will receive notifications through phone call and email regarding the signing of all documentation associated with the transfer.

You are given five (5) calendar days (if a Local buyer) and ten (10) calendar days (if an International/OFW buyer) to submit the additional documents and requirements listed below. Failure to submit the listed requirements within the allotted period will result in the cancellation of your request.

- Reviewed and signed documents

- Deed of Absolute Sales (DOAS)

- Contract to Sell (CTS)

- Home Improvement Contract (HIC) – if applicable

- Reservation Agreement (RA)

- Final Package Computation (FPC)

- Applicable Payment/Proof of Payment

- A new set of Post-dated checks (PDCs) reflecting the new payment schedule

The following are the requirements and procedures to process your request for Transfer of Ownership:

Transfer of ownership eligibility criteria include:

- The unit has not been fully paid

- The unit has not been turned over

- There are no penalties or unpaid balance under the account unless it is paid before the implementation of the transfer of ownership

REQUIREMENTS:

- Original/signed Request Letter addressed to Client Management Department

- Signed new Reservation Agreement (RA) of the New Buyer

- Signed new Buyer’s Information Sheet (BIS) of the New Buyer

- Signed Sample Package Computation

- Photocopy of two (2) valid Government-Issued ID of the New Buyer

- 2×2 ID Picture of the New Buyer

- Complete Standard Documentary Requirements

Your request will be routed for approval only upon the submission of the complete documents and requirements listed above. We allow the transfer of ownership to new buyers assessed as eligible and capable of purchasing the particular unit. Please note that you are only allowed to transfer ownership of the unit once (1x) during the equity period.

If the transfer request is made within seven (7) calendar days after the date of reservation, no transfer fee is charged. If made seven (7) calendar days after the reservation date, the buyer is required to pay a transfer fee amounting to Fifty Thousand Pesos (Php 50,000.00) per unit.

Upon the approval of your request for transfer of ownership, all legal documents associated with the transfer of ownership shall be prepared. You will be notified through call and email for the signing of all documentation related to the transfer.

| New Buyer | Original Buyer |

➢ Signing of Documents:

| ➢ Signing of Documents:

|

You are given five (5) calendar days (if a Local buyer) and ten (10) calendar days (if an International/OFW buyer) to submit the additional documents and requirements listed below. Failure to submit the listed requirements within the allotted period will result in the cancellation of your request.

- Reviewed and signed documents

- Deed of Absolute Sales (DOAS)

- Contract to Sell (CTS)

- Home Improvement Contract (HIC) – if applicable

- Final Package Computation (FPC)

- Deed of Assignment and Transfer Rights

- Arrears and Penalty Payment (if applicable)

- A new set of Post-dated checks (PDCs) bearing the name of the new buyer

The following are the requirements and procedures to process your request for addition/deletion of co-buyer/s:

Change in co-buyer/s eligibility criteria include:

- The unit has not been fully paid

- The unit has not been turned over

- There are no penalties or unpaid balance under the account unless it is paid before the implementation of the change in co-buyer/s.

REQUIREMENTS:

- Original/signed Request Letter by all registered buyers addressed to Client Management Department

- Signed new Reservation Agreement (RA) of updated Principal buyer/s

- Signed new Buyer’s Information Sheet (BIS) of updated Principal buyer/s

- Signed Sample Package Computation of updated Principal buyer/s

- Photocopy of two (2) valid Government-Issued ID of new Principal buyer/s

- 2×2 ID Picture of the new Principal buyer/s

- Complete Standard Documentary Requirements of new Principal buyer/s

Your request will be routed for approval only upon the submission of the complete documents and requirements listed above. We allow the addition/deletion of new co-buyers assessed as eligible and capable of purchasing the particular unit.

If the request is made within seven (7) calendar days after the date of reservation, no admin fee is charged. If made seven (7) calendar days after the reservation date, the buyer is required to pay an admin fee amounting to Twenty-Five Thousand Pesos (Php 25,000.00) per unit.

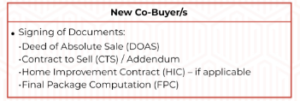

Upon the approval of your request, all legal documents associated with the addition/deletion of co-buyer/s shall be prepared. You will be notified through call and email for the signing of all documentation related to the transfer.

| New Co-Buyer/s |

➢ Signing of Documents:

|

You are given five (5) calendar days (if a Local buyer) and ten (10) calendar days (if an International/OFW buyer) to submit the additional documents and requirements listed below. Failure to submit the listed requirements within the allotted period will result in the cancellation of your request.

- Reviewed and signed documents

- Deed of Absolute Sales (DOAS)

- Contract to Sell (CTS) / Addendum

- Home Improvement Contract (HIC) – if applicable

- Final Package Computation (FPC)

- Arrears and Penalty Payment (if applicable)

A new set of Post-dated checks (PDCs) if the originally submitted PDC’s bear the name of the removed co-buyer.

If there are any changes in a buyer’s contact information, billing address or civil status, the developer must be informed immediately supported by the following requirements:

- Updating of Contact Information

- Original signed Request Letter or Customer Information Update Request Form signed by the buyer

- Updating of Billing Address

- Original signed Request Letter of Customer Information Update Request Form signed by the buyer

- Proof of Mailing address (at most one month prior to the request)

- Updating of Civil Status

- Original signed Request Letter or Customer Information Update Request Form signed by the buyer

- New Reservation Agreement (RA) reflecting the change in civil status

- Copy of valid and updated Government-issued ID of the spouses (reflecting the wife’s married name)

- Marriage Certificate (if married)

- Validated BIR Form 1904 (Application for Registration of One Time Taxpayer and Persons Registering under EO 98; securing a TIN to be able to transact with any government office) or BIR Form 2305 (Certificate of Update of Exemption and of Employer’s and Employee’s Information) if employed

- Validated BIR Form 1905 (Application for Registration Information Update/Correction/Cancellation) reflecting the application for change in civil status

- Court order approving a Petition for Legal Separation/Petition for Legal Separation of Properties/Petition for Annulment of Marriage/Petition for Declaration of Nullity of Marriage and the corresponding Certificate of Finality (if separated, and action filed in Philippine courts)

- Divorce Decree obtained abroad which is duly authenticated or apostilled, if applicable (if speared, and action filed in foreign courts)

The requirements for addition, transfer or deletion of Attorney in Fact (AIF) are:

- Original signed Request Letter or Customer Information Update Request Form signed by the buyer

- Three (3) sets of notarized (consularized/apostille if executed abroad) Special Power of Attorney (SPA)

- Two (2) Government-issued IDs of the AIF

What is the policy for account cancellations?

1. UNIT ACCEPTANCE

You will receive a Notice of Inspection through email and/or registered mail for the conduct of necessary inspections in preparation for the unit acceptance. No inspection shall be conducted without prior issuance and receipt of the notice. You are entitled to conduct said inspection on the day and schedule agreed with the developer.

If you fail to inspect the unit within fifteen (15) calendar days from the receipt of the notice, unless we agree in writing to extend the inspection period, you will be considered to have deemed accepted the unit, thereby expressly waiving all rights to inspect it for acceptance thereafter. All obligations related to the unit, including Association Dues, Real Property Tax (RPT), utilities, and warranty, commence upon the unit being considered accepted.

Issuance of Certificate of Acceptance:

- The Turnover Officer will assist you during the unit inspection. If at the point of inspection, there are no requests for repair works and you accept the unit you will then be issued a Certificate of Acceptance.

- In case repair works are requested during the unit inspection, this shall be documented in the Punch List Form along with the commitment date of your return for another inspection. Request for repairs who have failed to return on the agreed date as indicated in the Punch List Form shall no longer be entertained and the unit shall be deemed accepted. A Certificate of Deemed Acceptance will be issued to you through email and/or registered mail.

2. TURNOVER AND MOVE-IN

You are cleared to move in once the following requirements have been fulfilled:

- Full payment of equity/down payment

- Complete documentary requirements

- Settlement of arrears in equity and/or monthly amortization payments, and other unpaid charges

- Release of loan proceeds to the developer

- Full settlement of Loan Difference (if applicable). If not settled, an endorsement of Authority to Move-in from the Documentation department is necessary.

- Issued Certificate of Acceptance

- Payment of Membership Fee

We will inform you when your unit is ready for turnover. During which, the turnover kit and the keys to your unit/s is turned over to you. You are also required to attend the orientation conducted by the Property Management Office. In the orientation, you will be reminded of the house rules and regulations, building operations, and home improvement guidelines.

1. UNIT ACCEPTANCE

You will receive a Notice of Inspection through email and/or registered mail for the conduct of necessary inspections in preparation for the unit acceptance. No inspection shall be conducted without prior issuance and receipt of the notice. You are entitled to conduct said inspection on the day and schedule agreed with the developer.

If you fail to inspect the unit within fifteen (15) calendar days from the receipt of the notice, unless we agree in writing to extend the inspection period, you will be considered to have deemed accepted the unit, thereby expressly waiving all rights to inspect it for acceptance thereafter. All obligations related to the unit, including Association Dues, Real Property Tax (RPT), utilities, and warranty, commence upon the unit being considered accepted.

Issuance of Certificate of Acceptance:

- The Turnover Officer will assist you during the unit inspection. If at the point of inspection, there are no requests for repair works and you accept the unit you will then be issued a Certificate of Acceptance.

- In case repair works are requested during the unit inspection, this shall be documented in the Punch List Form along with the commitment date of your return for another inspection. Request for repairs who have failed to return on the agreed date as indicated in the Punch List Form shall no longer be entertained and the unit shall be deemed accepted. A Certificate of Deemed Acceptance will be issued to you through email and/or registered mail.

2. TURNOVER AND MOVE-IN

You are cleared to move in once the following requirements have been fulfilled:

- Full payment of equity/down payment

- Complete documentary requirements

- Settlement of arrears in equity and/or monthly amortization payments, and other unpaid charges

- Release of loan proceeds to the developer

- Full settlement of Loan Difference (if applicable). If not settled, an endorsement of Authority to Move-in from the Documentation department is necessary.

- Issued Certificate of Acceptance

- Payment of Membership Fee

We will inform you when your unit is ready for turnover. During which, the turnover kit and the keys to your unit/s is turned over to you. You are also required to attend the orientation conducted by the Property Management Office. In the orientation, you will be reminded of the house rules and regulations, building operations, and home improvement guidelines.

Processing of your title will commence upon full payment of the Total Contract Price.

The following documents will be released to you after the one (1) year processing period:

- Notarized Deed of Absolute Sale (DOAS)

- Tax Declaration Form

- Condominium Certificate of Title (CCT) or Transfer Certificate of Title (TCT)

- Tax Clearance

Ownership Responsibilities and Unit Use

All registered OWNERS shall automatically be members of the CORPORATION/ASSOCIATION and shall comply with their obligations to pay assessments and dues to the CORPORATION/ASSOCIATION.

- REGULAR ASSESSMENT OR CONDOMINIUM DUES/ASSOCIATION DUES

This is a regular assessment to cover the estimated monthly operating expenses of the CORPORATION/ASSOCIATION. These regular expenditures include costs for security and janitorial services, electric and water consumption of the common areas, administrative expenses, and other recurring common expenses including taxes and insurance premiums. Association dues may vary from one project to another. - MEMBERSHIP FEE

The obligation of the OWNERS to pay the Membership Fee shall commence once an owner is deemed to have accepted the unit/property. The Membership Fee shall be non-refundable and this obligation is separate and independent from the obligation to pay for the other assessments. - SPECIAL ASSESSMENT

These are expenses deemed necessary but are not considered in the regular assessment such as improvement works or beautification projects approved by the corporation. This may also include funds necessary to augment deficiency from insurance proceeds, if any. - REAL PROPERTY TAX (RPT)

The OWNERS are obligated to directly pay the Real Property Tax (RPT) to the government for their respective Home Units upon turnover of the unit. - MORTGAGE REDEMPTION INSURANCE (MRI) AND FIRE INSURANCE

Mortgage Redemption Insurance (MRI) and FIRE Insurance premiums must be paid annually with bills sent by the bank. For Pag-IBIG loans, MRI and Fire Insurance premiums are included in the monthly amortization.

Your unit is supported by the following warranty starting from the date of acceptance or deemed acceptance.

FOR CONDOMINIUM UNITS:

| DURATION | PARTICULARS |

| 3 months | Tile Works |

| Installation Defects – Hollow Tiles | |

| 3 months | Vinyl Works (if applicable) |

| Installation Defects – Warps and loose installation | |

| 3 months | Kitchen Counter and Cabinets |

| Misalignments and warping – Cabinet Doors and panels | |

| Functionality defects - Hardware (Hinges, handles and drawer slides) | |

| 1 month upon activation | Toilet and Bath Fixtures |

| Installation defects – water closet & lavatory | |

| Functionality defects – water closet & lavatory | |

| Factory defects – exhaust fans | |

| 3 months | Doors and Windows |

| Application defects – sealants | |

| Functionality defects – hardware (handles, lock, rollers, and other accessories) | |

| 1 month upon activation | Water lines and Drainage |

| Leaks and waterproofing | |

| Clogging (construction debris) | |

| 1 month upon activation | Electrical components and devices |

| Functionality defects – switches, outlets, panel boards | |

| Installation defects – switches, outlets, panel boards |

FOR HOUSE AND LOT:

| 3 months | Tile Works |

| Installation Defects – Hollow Tiles | |

| 3 months | Vinyl Works (if applicable) |

| Installation Defects – Warps and loose installation | |

| 3 months | Kitchen Counter and Cabinets |

| Misalignments and warping – Cabinet Doors and panels | |

| Functionality defects - Hardware (Hinges, handles and drawer slides) | |

| 1 month upon activation | Toilet and Bath Fixtures |

| Installation defects – water closet & lavatory | |

| Functionality defects – water closet & lavatory | |

| Factory defects – exhaust fans | |

| 3 months | Doors and Windows |

| Application defects – sealants | |

| Functionality defects – hardware (handles, lock, rollers, and other accessories) | |

| 1 month upon activation | Water lines and Drainage |

| Leaks and waterproofing | |

| Clogging (construction debris) | |

| 1 month upon activation | Electrical components and devices |

| Functionality defects – switches, outlets, panel boards | |

| Installation defects – switches, outlets, panel boards | |

| 1 year | Roofing Works (Leaks) |

Note: Upgrades, improvements, and other personal modifications to your unit may only be allowed after the official acceptance.

To maintain the long-term quality of your investment there are rules contained in the Master Deed with Declaration and Restrictions (MDDR) and House Rules that need to be followed or enforced for the common good of the owners and residents of the Project. The rules are designated to:

- Ensure the efficient and orderly management and operations of the condominium, for the health, safety, and welfare of all residents.

- Ensure the right to peaceful and quiet enjoyment of all owners and residents of their respective units and the common areas.

- Maintain the aesthetic appearance and functionality of facilities of the Project;

- Enhance the property value of each owner’s investment in the Project.

- GENERAL RESTRICTIONS

All unit owners are required to comply with the House Rules which must likewise be observed by the following parties whenever they are within the premises of the Project:- members of their family and their household help;

- their tenants and members of the family and household help of said tenants;

- their guests and the guests of their tenants; and

- other individuals transacting business with them.

- MEMBERSHIP, DUES, AND OTHER ASSESSMENTS

- All Buyers shall automatically become members of the Corporation. Upon becoming a member of the Condominium Corporation, a unit owner shall pay the Corporation a Membership Fee.

- A Unit Owner is considered to be a member of the Condominium Corporation upon actual acceptance/deemed acceptance of their units.

- Membership is mandatory for Unit Owners and this requirement and the obligation are attached in the Master Deed.

- All unit owners, tenants, and/or residents shall be proportionately liable for expenses to maintain all common areas, based on their share in the total saleable area of residential units and parking units.

- The Condominium Corporation may from time to time designate such amount to be collected from Unit Owners as and by way of special assessment.

- Assessments not paid on the prescribed due date will bear interest per month as provided in the Master Deed.

- USE OF INDIVIDUAL UNITS

- Each residential unit shall be occupied purely for residential purposes only.

- To prevent overcrowding in the unit, the maximum number of residents including infants, children, household staff, residing nurses, bodyguards etc. allowed per unit are:

- Studio – 3-4 Residents only

- One Bedroom – 5 Residents only

- Two Bedroom – 7 Residents only

- For safety and security purposes, the residential units shall not be used as commercial.

- All lease contracts shall contain an undertaking by both the unit owner/lessor and the tenant to hold themselves jointly liable and responsible to the Condominium Corporation/ Homeowners Association.

- AMENITIES AND COMMON AREAS

- The amenities shall only be used and enjoyed for recreational purposes of the unit owners, tenants, and/or residents of the Project.

- Unit owners who lease out their units automatically transfer their right to use the amenities to their tenants until the expiration of the lease contract.

- Delinquent unit owners, tenants, and/or residents shall not be allowed to use the amenities during the period of delinquency.

- DRIVING AND PARKING RULES

- Parking units shall be used solely for the temporary storage of motor vehicles.

- Parking units shall not be used as storage of any kind.

- Each unit owner, tenant, and/or resident is required to park in his/her assigned slot only.

- Only authorized persons by the unit owner or tenant can bring their registered vehicle/s in or out of the parking area.

- A maximum speed limit of 10 Kph shall be observed; Overtaking is strictly prohibited.

- UNIT IMPROVEMENT

- Unit owners are required to advise the Property Management Office of any improvement/renovation works or servicing that will be undertaken within the unit.

- Unit owners shall post a renovation bond with an amount prescribed by the Condominium Corporation.

The Master Deed with Declaration and Restrictions (MDDR) will be included in the Contract to Sell (CTS). The turnover kit will provide additional information regarding project rules and regulations.

Domesticated Pets (small breed dogs and cats) are permitted within the building premises subject to the conditions, which may, from time to time, be modified, amended, or revised by the Condominium Corporation. Each residential unit is allowed to keep a maximum of two (2) pets measuring no more than two (2) feet in height.

Unit owners are required to advise the Property Management Office of any improvement/renovation works or servicing that will be undertaken within the unit.

Unit owners shall post a renovation bond with an amount prescribed by the Condominium Corporation.

The Master Deed with Declaration and Restrictions (MDDR) will be included in the Contract to Sell (CTS). The turnover kit will provide additional information regarding project rules and regulations.

SPOT CASH PAYMENT TERM

The full Total Contract Price (TCP) is paid in cash 30 days after reservation date

DEFERRED PAYMENT TERM

The Full Total Contract Price is paid throughout the equity period.

* STANDARD PAYMENT TERM

The Net Equity is divided equally and is paid throughout the equity period and the remaining balance is paid at the end of the equity term through cash, financing institutions, or in-house loan.

SUBMISSION OF POST-DATED CHECKS:

You are required to prepare the number of Post-Dated Checks (PDCs) covering your down payment

* If the unit is still under construction, issued PDCS must cover the entire equity period

* If the unit is Ready for Occupancy (RFO), PDCs should cover the required down

payment stated in the price list/Final Package Computation

If you choose to pay the full balance in cash (whether RFO or not), then the PDCS should cover the entire equity period

If you choose to pay the full balance through financing, PDCs should still cover the entire equity period

If you choose to pay through an in-house loan, you should cover the entire down payment and the first 5 years of monthly amortization either through post-dated checks (PDCs) or enrollment via BDO ADA Facility

PAYMENT OPTIONS:

Your down payment and other recurring payments can be paid through the following:

•Postdated Checks (PDCS)

Auto-debit Arrangement with BDO

Note: If you are an OFW/Overseas-based individual, you must designate a family member residing in the Philippines as your ATTORNEY-IN-FACT (AIF) The Alf will be authorized to apply for an ADA facility or sue the necessary post-dated checks for the monthly down payment on your behalf

Your remaining balance penalties, fees, and other one-time payments can be paid through the following:

BDO Bills Payment

Over-the-Counter Bills Payment for Cash and Check

Through the BDO Mobile App Through BDO Online Banking

Check

Cash

All required documents and payments must be completed within thirty or sixty (30-60) days from the approved reservation date. Failure to do so will result in forfeiture and cancellation of your reservation.

The documents listed below are required for submission:

* Proof of Billing Address (must be the latest billing statement)

* Photocopy of Birth Certificate

Photocopy of Certificate of No Marriage (if single)

* Photocopy of Marriage Certificate (if married)

* Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry Judgement of the Court Order Granting Legal Separation

[if separated/annulled/divorce)

•Photocopy of Death Certificate of Spouse (if widowed)

* Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

* Photocopy of Tax Identification No. (TIN)

* Notarized Special Power of Attorney (SPA) if executed in the Philippines, and

a Consularized SPA if executed abroad (if applicable)

* Oath of Allegiance (if buyer is a dual citizen)

BALANCE PAYMENT THROUGH BANK FINANCING:

If undergoing bank financing, you need to complete a Loan Application Form along with the specified requirements. These documents are submitted to our accredited banks for the processing of your bank loan approval, ideally (6) six months before the end of your equity period. Please note that it is at the discretion of the developer to determine which bank your loan application will be submitted to based on your qualifications.

PERSONAL DOCUMENTS: (Must be completed within 30 days from the date of reservation)

* Proof of Billing Address (must be the latest billing statement)

Photocopy of Birth Certificate

Photocopy of Certificate of No Marriage (if single)

Photocopy of Marriage Certificate (if married)

Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry

Judgement of the Court Order Granting Legal Separation

(if separated/annulled/divorce)

Photocopy of Death Certificate of Spouse (if widowed)

Photocopy of Approved Court Order Appointing the Parents/Legal Guardian [if minor)

INCOME DOCUMENTS:

IF LOCALLY EMPLOYED (Must be completed within 30 days from the date of reservation)

Certificate of Employment (CEO) with salary breakdown

* Copy of payslip (at least 6 months)

* Verified Tax Identification Number (TIN) -Principal Buyer and Spouse if Married Latest Income Tax Return (ITR) with receipt for the last year

* Photocopy of bank statement (at least 6 months)

IF SELF-EMPLOYED (Must be completed within 30 days from the date of reservation)

* Verified Tax Identification Number (TIN) - Principal Buyer and Spouse if Married Latest Income Tax Return (ITR) with receipt for the last 3 years

Audited Financial Statement for the last 3 years

* Business Permit

DTI Issued Certificate of Registration

* Copy of lease contract and title of contract (optional)

* Photocopy of bank statement (at least 6 months)

IF OVERSEAS FILIPINO WORKERS (Must be completed within 60 days from the date of reservation)

* Certificate of employment/job contract with salary breakdown

•Copy of payslip (at least 6 months)

* Verified Tax Identification Number (TIN) -Principal Buyer and Spouse if Married

•Photocopy of Passport with Arrival Date

* Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

* Photocopy of any (2) valid government-issued IDs with signature and

contact number of Attorney In-Fact (AIF) Attorney In-Fact (AIF) proof of billing

Photocopy of bank statement (at least 6 months)

•Proof of remittance (at least 6 months)

IF CORPORATE (Must be completed within 30 days from the date of reservation)

Audited Financial Statement for the last 3 years

Verified corporate Tax Identification Number (TIN)

Latest Income Tax Return (ITR) with receipt for the last 3 years

Photocopy of BIR Certificate of Registration

Photocopy of recent BIR Form 1903

Business permit and license

Certified True Copy of Secretary Certificate

Sec Certificate

Board Resolution

Valid ID of the official representative of the company

Valid ID of corporate secretary

Certified True Copy of Articles of Incorporation

Photocopy of bank statement (at least 6 months)

IF FOREIGN (Must be completed within 60 days from the date of reservation)

Certificate of Employment (COE) and compensation

Copy of payslip (at least 6 months)

Tax Identification Number (TIN)

Photocopy of bank statement (at least 6 months)

* Photocopy of any (2) valid government-issued IDs with signature

* Proof of Billing of Attorney In-Fact (AIF)

* Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

* Photocopy of any (2) valid government-issued IDs with signature and contact number of Attorney In-Fact (AIF)

You'll be notified via email once your loan application is submitted to the bank/s.

Below is the list of accredited banks:

BDO

* Security Bank

BPI

RCBC

PNB

China Bank

AUB

Yuanta Savings Bank

* Union Bank

After your application is approved, the bank will provide a Notice of Approval (NOA), confirming that your loan request has been thoroughly reviewed and accepted. It's crucial to verify the loan terms with the bank once you receive your NOA. Following this, the bank will proceed to prepare and issue a Letter of Guarantee (LOG).

The release of your loan normally takes (7) working days from receipt of confirmed/- signed LOG, settlement, and submission of the following post-approval requirements:

* Confirmed/Signed Letter of Guarantee (LOG) and Deed of Undertaking (DOU)

* Signed loan documents

* Disclosure Statement

Real Estate Mortgage

Loan Agreement with Promissory Note

Special Power of Attorney (SPA)

Note: Signed & settled to the bank prior to the release of the Bank Guaranty (Bank Process)

* Other requirements

Post-dated checks

Mortgage Redemption Insurance (MRI)

Note: Signed & settled to the bank prior to the releuse of the Bank Cuaranty (Bank Process)

Developer Requirements:

* Full payment of equity/down payment Settlement of loan difference (if applicable)

Signed Contrat to Sell (CTS)

Note: Signed & settled to the developer prior to loan release (Developer Process)

BALANCE PAYMENT THROUGH PAG-IBIG (HDMF):

You are required to submit a fully accomplished Pag-IBIG Housing Application Form along with the necessary documents listed below. These documents are submitted to Pag-IBIG for the processing of your housing loan approval, preferably (6) six months before the end of your equity period. All documents submitted to Pag-IBIG must be either original or certified true copies.

PERSONAL DOCUMENTS:

Proof of Billing Address (must be the latest billing statement)

Photocopy of Birth Certificate

Photocopy of Certificate of No Marriage (if single)

* Photocopy of Marriage Certificate (if married)

Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry

Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

Photocopy of Death Certificate of Spouse (if widowed)

Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

INCOME DOCUMENTS:

IF LOCALLY EMPLOYED (Must be completed within 30 days from the date of reservation)

* Original notarized Certificate of Employment and Compensation (CEC), indicating the gross monthly income and monthly allowances or monthly monetary benefits received by the employee

For Government Employees who will be paying their loan amortization through salary deduction, the Certified one (1) month payslip, within the last three (3) months before the date of loan application must be submitted together with CEC

or Income Tax Return (ITR)

* Photocopy of Employees Statement of Accumulated Value

Photocopy of the latest Income Tax Return (ITR) for the year immediately preceding the date of the loan application, with attached BIR Form No. 2316, stamped and received by the BIR

Original copy of Certified one (1) month payslip, within the last three (3) months

before the date of loan application

IF SELF-EMPLOYED (Must be completed within 30 days from the date of reservation)

* Photocopy of latest Income Tax Return

Photocopy of latest Audited Financial Statements

•Photocopy of DTI Issued Certificate of Registration

Photocopy of Business Permit & License

Commission Vouchers Reflecting the Issuer's Name and Contact Details (for the

Last 12 months)

•Photocopy of bank Statements or Passbook for the last 12 months (in case income is sourced from foreign remittances, pensions, etc.)

* Photocopy of Lease Contract and Tax Declaration (if income is derived from rental payments) • Certified True Copy of Transport Franchise issued by an appropriate government

agency (LGU for tricycles, LTFRB for other PUVS)

Certificate of Engagement issued by the Owner of a Business

IF OVERSEAS FILIPINO WORKERS (Must be completed within 60 days from the date of reservation)

Photocopy of Employment Contract

Photocopy of Employment Contract between employee and employer, or

Photocopy of POEA Standard Contract

Photocopy of Employees Statement of Accumulated Value

Photocopy of Certificate of Employment and Compensation (CEC)

Original copy of CEC written on the Employer/Company's official letterhead; or CEC signed by the employer (for household staff and similarly situated

employees) supported by a photocopy of the employer's ID or passport

* Original copy of Special Power of Attorney (SPA) notarized by a Philippine Consular Officer, or SPA notarized by a local notary (of the country where the member is working) but duly authenticated by the Philippine Consulate

The PAGIBIG may also require any or a combination of the following docu-

-Pay slip indicating income received and period covered

Valid OWWA Membership Certificato

Overseas Employment Certificate

Passport with appropriate visa (working visa)

Residence card/permit (permit to stay indicating work as the purpose)

Bank remittance record

Professional License issued by Host Country/Government

Here is the list of Pagibig documents that you must also sign before your housing loan application is endorsed.

PAGIBIG Housing Loan Application Form

* Authorization to conduct CIBI (Credit/Background Investigation)

Membership Status Verification Slip (MSVS)

Loan Mortgage Agreement (signed by the buyer and the developer's representative)

•Promissory Note (signed by the buyer and the developer's representative; should be notarized)

Certificate of Acceptance (signed by the buyer and the developer's representative; should be notarized)

Approved Preliminary Appraisal

Certificate of House and Lot Acceptance (signed by the buyer and the developer's representative; should be notarized)

* Deed of Assignment (signed by the buyer and the developer's representative; should be notarized)

* Deed of Absolute Sale (signed by the buyer and the developer's representative; should be notarized)

Contract to Sell (signed by the buyer and the developer's representative; should be notarized)

Developer's Sworn Certification (signed by the buyer and the developer's representative, should be notarized)

* Lot Plotting

You'll be notified via email once your housing loan application is submitted to Pagibig

For approved loan applications, Pagibig shall issue a Notice of Approval (NOA). This document serves as a confirmation of the housing loan's approval.

Upon issuance of the NOA, you must confirm and sign the document. If you are an Overseas Filipino Worker (OFW), the designated Attorney-In-Fact (AIF) is authorized to sign the NOA on your behalf. In case you fail to sign the NOA after one (1) month from the date of approval, PAGIBIG will consider the loan application withdrawn,

Note: If the application is withdrawn, the developer will have the option to re-apply with a re-filing Fee of Php 1,000 which will be shouldered by the buyer.

The release of your loan normally takes seven (7) working days from receipt of the following post-approval requirements including house inspection. These documents shall be submitted to Pagibig along with the title before the release of loan proceeds.

Signed Loan Documents

Loan Mortgage Agreement

Promissory Note

Deed of Absolute Sale (DOAS)

Certificate tof Acceptance

Tax Declaration

Real Property Tax Receipt

Tax Clearance

Annotated Deed of Assignment (DOA)

Special Power of Attorney/SPA)

Lot Plan

* Developer Requirements:

* Full payment of equity/down payment Settlement of loan difference (if applicable)

Signed Contrat to Sell (CTS)

Note: Signed & settled to the developer prior to loan release (Developer Process!

BALANCE PAYMENT THROUGH IN-HOUSE LOAN:

When applying for an in-house loan, you will undergo an assessment to determine your eligibility. Upon approval of your in-house loan application, you will be required to submit the following documents and requirements

Auto-Debit Arrangement (ADA) Application Form

The down payment and the remaining balance under the in-house loan shall be

* Insurance

Mortgage Redemption Insurance (MRI) and Fire Insurance. This insurance provides coverage in case of the death of the buyer, as well as loss or damage of property caused by fire. paid through the ADA

Complete Personal and Income Documents

PERSONAL DOCUMENTS:

Proof of Billing Address (must be the latest billing statement)

Photocopy of Birth Certificate

-Photocopy of Certificate of No Marriage (if single)

Photocopy of Marriage Certificate (if married)

Photocopy of Certificate of Finality/Annulment Decree of Divorce/Entry

Judgement of the Court Order Granting Legal Separation (if separated/annulled/divorce)

Photocopy of Death Certificate of Spouse (if widowed)

Photocopy of Approved Court Order Appointing the Parents/Legal Guardian (if minor)

INCOME DOCUMENT:

IF LOCALLY EMPLOYED (Must be completed within 30 days from the date of reservation)

Certificate of Employment (CEO) with salary breakdown Copy of payslip (at least 6 months)

- Verified Tax Identification Number (TIN)-Principal Buyer and Spouse if Married

Latest Income Tax Return (ITR) with receipt for the last year Photocopy of bank statement (at least 6 months)

IF SELF-EMPLOYED (Must be completed within 30 days from the date of reservation)

Verified Tax Identification Number (TIN)-Principal Buyer and Spouse if Married

Latest Income Tax Return (ITR) with receipt for the last 3 years

Audited Financial Statement for the last 3 years

Business Permit

- DTI Issued Certificate of Registration

- Copy of lease contract and title of contract (optional)

- Photocopy of bank statement (at least 6 months)

- Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

IF OVERSEAS FILIPINO WORKERS (Must be completed within 60 days from the date of reservation)

Certificate of employment/job contract with salary breakdown

- Copy of payslip (at least 6 months)

- Verified Tax Identification Number (TIN)- Principal Buyer and Spouse if Married

Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

Photocopy of Passport with Arrival Date

Photocopy of any (2) valid government-issued IDs with signature and contact

number of Attorney In-Fact (AIF)

Attorney In-Fact (AIF) proof of billing

Photocopy of bank statement (at least 6 months)

Proof of remittance (at least 6 months)

IF CORPORATE (Must be completed within 30 days from the date of reservation!

Audited Financial Statement for the last 3 years

- Verified corporate Tax Identification Number (TIN)

Latest Income Tax Return (ITR) with receipt for the last 3 years

Photocopy of BIR Certificate of Registration

Photocopy of recent BIR Form 1903

Business permit and license

-Sec Certificate

- Certified True Copy of Secretary Certificate

Board Resolution

- Valid ID of corporate secretary

-Valin ID of the official representative of the company

Certified True Copy of Articles of Incorporation

Photocopy of bank statement (at least 6 months)

IF FOREIGN (Must be completed within 60 days from the date of reservation]

Certificate of Employment (COE) and compensation

Copy of payslip (at least 6 months) -Tax identification Number (TIN)

Photocopy of bank statement (at least 6 months)

Photocopy of any (2) valid government-issued IDs with signature

Proof of Billing of Attorney In-Fact (AIF)

-Special Power of Attorney (SPA) if executed in the Philippines, Consularized if executed abroad

Photocopy of any (2) valid government-issued IDs with signature and contact number of Attorney in Fact (AIF)

You have the option to secure an in-house loan covering up to eighty percent (80%) of the total contract price which can be payable for up to ten (10) years following the prescribed interest rates.

The in-house loan payment terms and rates are listed below:

PAYMENT TERMS

IN-HOUSE RATE

10 years = 20%

5 years = 18%

3 years = 16%

1 year = 12%

Note: Any payment structure that does not fall within the implementing guidelines will be subject to special approval from the management.

While preparing the Contract to Sell and other legal paperwork, we will also generate the In-House Loan Agreement. This agreement contains the payment terms, interest rates, and the repayment schedule of the loan. The In-House Loan Agreement should be signed before the first loan amortization payment schedule

A penalty equivalent to three percent (3%) of outstanding payments shall be charged in full if payment is not received on or before the scheduled monthly due date.

Example:

Monthly Equity: P50,000.00

Hit Date: Every 5th of the month

If you did not pay for the January monthly due. The penalty shall be applied to the equity amount one day after the due date.

The penalty shall be computed as follows:

Requests to change the mode of balance payment (eg, from bank financing to cash, Pag-IBIG financing, or in-house loan) must be made at least eight (8) months before the end of the equity period. Additionally, you will undergo a pre-assessment to determine eligibility. Upon qualifying in the pre-assessment, the developer will approve your request for the change in the balance payment term.

If a request to change the mode of balance payment is made after the deadline, a penalty of Fifty Thousand Pesos (Php 50,000.00) will be charged to the buyer. This penalty applies to all types of balance payment conversions except for bank financing to cash.

Note: The developer shall reserve the right to change the penalty amount at any time without

further notice

If there are any changes in a buyer's contact information, billing address or civil status, the developer must be informed immediately supported by the following requirements:

1. Updating of Contact Information

Original signed Request Letter or Customer Information Update Request Form

signed by the buyer

2. Updating of Billing Address

* Original signed Request Letter of Customer Information Update Request Form signed by the buyer

* Proof of Mailing address (at most one month prior to the request)

3. Updating of Civil Status

* Original signed Request Letter or Customer Information Update Request Form

signed by the buyer New Reservation Agreement (RA) reflecting the change in civil status

Copy of valid and updated Government-issued ID of the spouses (reflecting the wife's married name)

Marriage Certificate (if married)

20

Validated BIR Form 1904 (Application for Registration of One Time Taxpayer and Persons Registering under EO 98; securing a TIN to be able to transact with any government office) or BIR Form 2305 (Certificate of Update of Exemption and of Employer's and Employee's Information) if employed

Validated BIR Form 1905 (Application for Registration Information

Update/Correction/Cancellation) reflecting the application for change in civil status Court order approving a Petition for Legal Separation/Petition for Legal Separation of Properties/Petition for Annulment of Marriage/Petition for Declaration of Nullity of Marriage and the corresponding Certificate of Finality (if separated, and action Filed in Philippine courts)

Divorce Decree obtained abroad which is duly authenticated or apostilled if applicable (if speared, and action filed in foreign courts)

All registered OWNERS shall automatically be members of the CORPORATION/ASSOCIATION and shall comply with their obligations to pay assessments and dues to the CORPORATION/ASSOCIATION.

1. REGULAR ASSESSMENT OR CONDOMINIUM DUES/ASSOCIATION DUES

This is a regular assessment to cover the estimated monthly operating expenses of the CORPORATION/ASSOCIATION. These regular expenditures include costs for security and janitorial services, electric and water consumption of the common areas, administrative expenses, and other recurring common expenses including taxes and insurance premiums. Association dues may vary from one project to another.

I

2. MEMBERSHIP FEE